Oh silly millenial, root of all problems, look at how your parents raised you!

Well, I’m on the later end of what is called millenial (I was underage by year 2000), and all I see around me is extremely educated, extremely smart people, making giant salaries, working for the most touted companies around, and… they can barely make it. Seriously.

They delay having kids (the lucky ones who have a home country come back), for they cannot buy houses, with the cheapest hover around $600k being outbid seven times by 30% (I’ve heard that twice from PhD and JD couples.)

And those of us who have to rent have to spend the majority of our salaries in rent (average rent in Berkeley is $3800), thus making it impossible to save enough for the down payment (an older colleague of mine told me about the time, say 30years ago, were a union worker could afford several mortgage in the Bay Area). This is not only limited to the Bay area: country-wide renters are paying 70% of their base income on rent (reference needed) than the generation before.

The problem won’t be fixed by not indulging on avocado toasts, and while criticism of the character of millenial is funny at best, it seems that the economic problem is rooted in two main factors: poor urban planning and poor retirement plans.

The first part is quite obvious: the economic activity in the Silicon Valley spurred a population growth, but they mostly built single-occupancy homes, and couldn’t cope with further increase. Thus, price went up locally, and displaced the tech population to San Francisco, which in turn displaced the San Francisco population to the East Bay, and the Oakland working class further to the South — increasing rent price for everyone, not to mention the necessary commute this entails. Eventually, the problem will take care of itself (net new arrivals to the Golden State have fallen 17% since February), but this is not comforting.

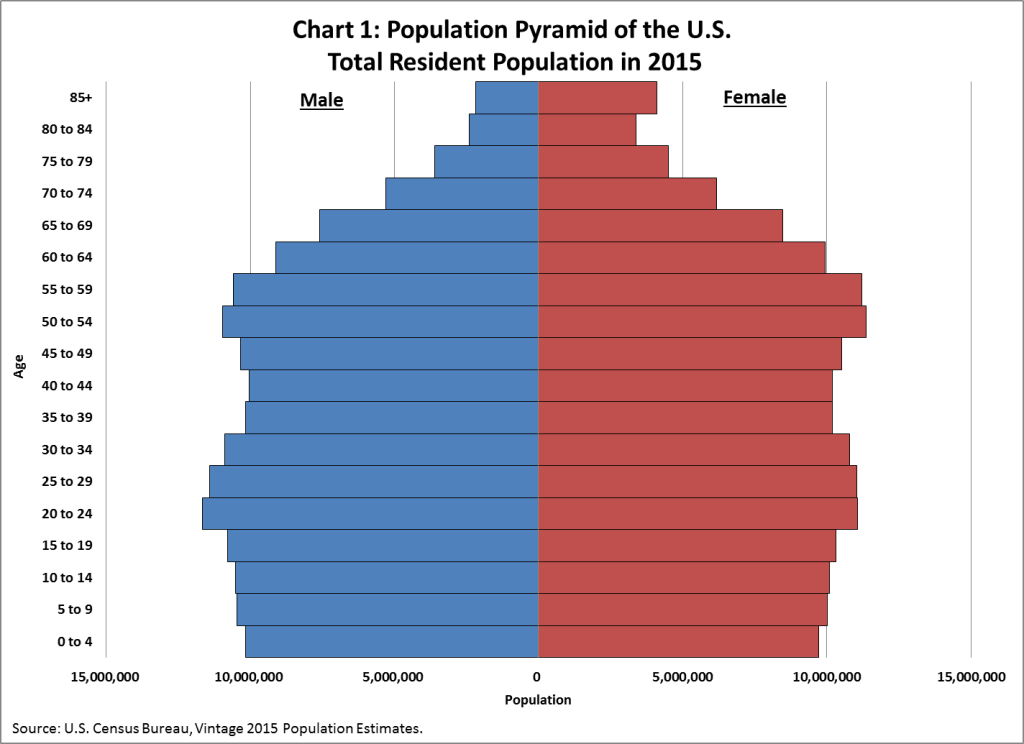

The second part is a bit more convoluted. The baby-boom created a imbalance between generation, and the first who came could buy homes at a cheaper price.

Due to poor generational transfer (usually through taxes), the real estate is owned in majority by the older population, who in turn use high rent to compensate for the lack of proper retirement funding (the problem is caused by the difficulty to plan for the future, see Hervé Le Bras’ talk on the difficulty of planning when demographics is involved (in French) – and partly, owing to the increase of life expectancy, because people no longer die at random, thus compromising forecasts.

High rent is reverse generational transfer, and it’s hurting — increasing income inequality further.

(update June 3rd, 2017: apparently, retirement is a bigger problem that I envisioned: The World faces a $400 Trillion disaster (qz.com).)

edit January 2018: I read this fantastic piece (if brutal) on the millenials: The Premium Mediocre Life of Maya Millennial (Venkatesh Rao)